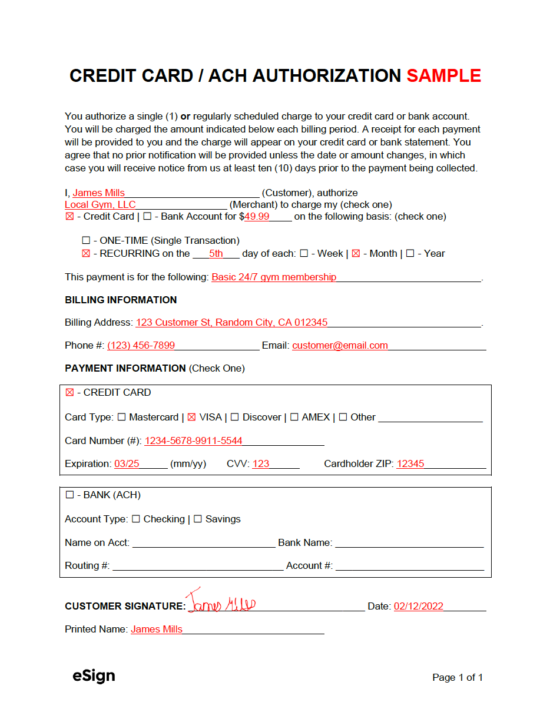

A credit card / ACH authorization form is a document that gives merchants permission to charge a customer’s credit card or bank account without their presence. The document, once signed by the customer, helps companies avoid chargebacks, as the customer’s legal signature makes it very difficult for them to argue that the charge is fraudulent. The document can be used for both one-time payments and recurring transactions.

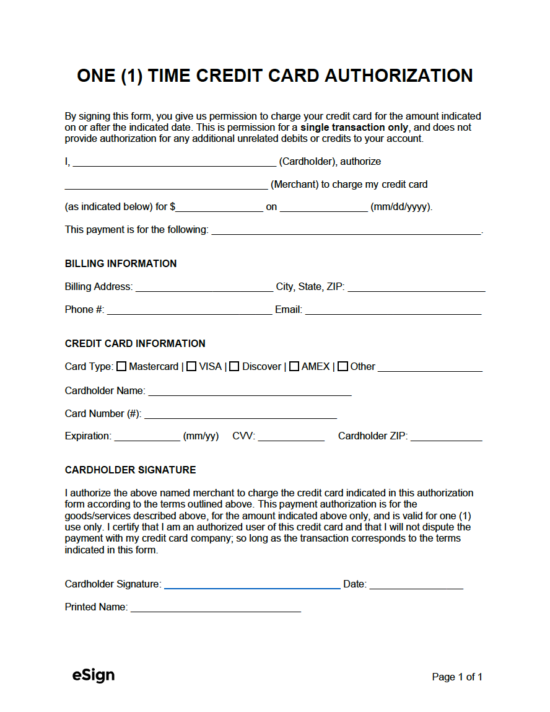

One (1) Time Credit Card Payment Authorization Form – For receiving the approval to charge a customer’s credit card ONCE.

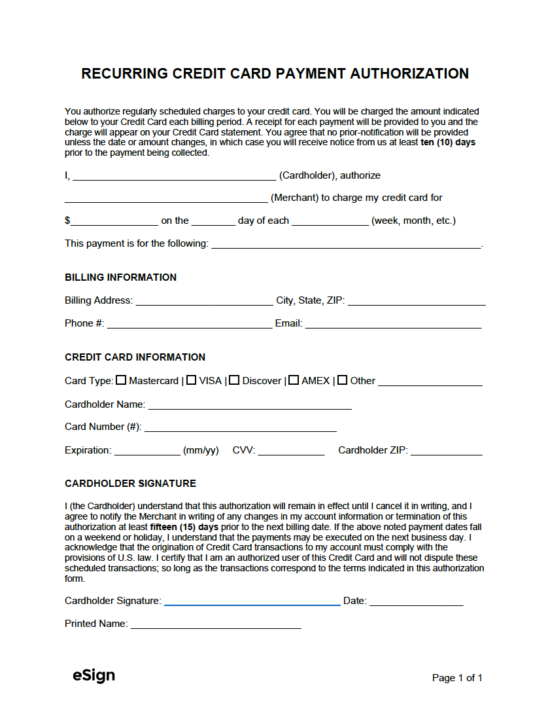

Recurring Credit Card Payment Authorization Form – Used for obtaining consent from a customer to charge their card on a recurring basis.

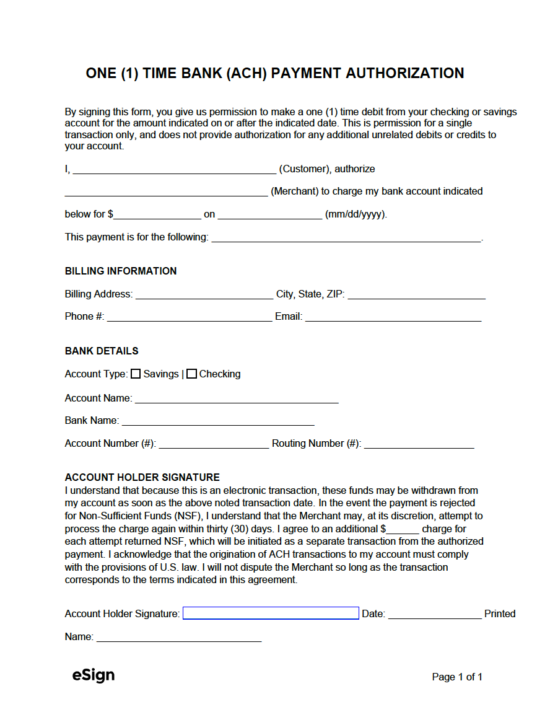

One (1) Time ACH (Bank) Payment Authorization Form – Gives a merchant the right to withdraw from a customer’s checking or savings account ONE time.

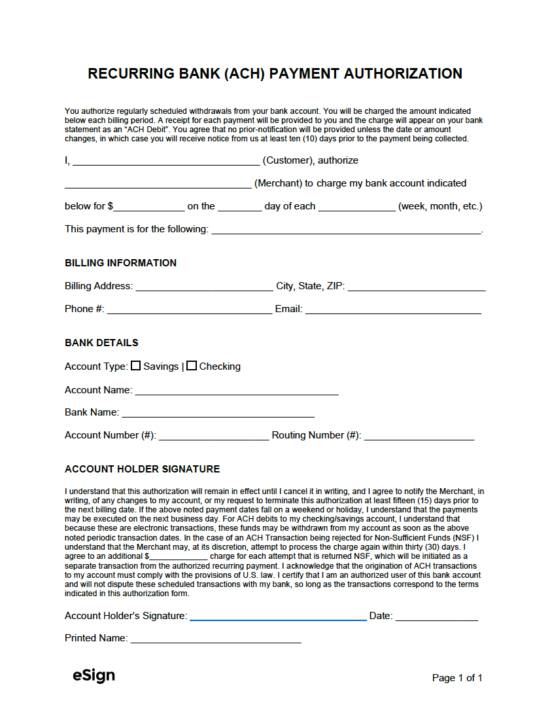

Recurring ACH (Bank) Payment Authorization Form – Provides a merchant with the ability to withdraw from a customer’s bank account on a recurring basis (i.e., weekly, monthly, quarterly, annually, etc.).

To sufficiently protect the issuing company from a chargeback, the form should contain the following information (at a minimum):

Once the customer opts to sign up for a membership or subscription with the merchant, they should be given the authorization form to complete. If the merchant will be using an authorization form for the same type of charge for multiple customers on a regular basis, they may choose to complete specific fields ahead of time so that they have a template they can keep reusing. Information such as the contact info of the merchant, the amount ($) of the charge, whether it is recurring or not, and the date of recurring payment (if applicable) can be filled in to make the template. Then, the merchant will only need to make a copy of the template for each future customer.

Once all other fields have been completed, the customer will need to input their payment method (credit card or bank info) followed by their signature. Their signature can be collected by uploading the authorization form to eSign or by printing the document and writing it by hand.

With the completed authorization in hand, the merchant can begin charging the customer’s credit card or withdrawing from their bank account. It is very important that the merchant charges the same amount ($) as was entered onto the form. If a charge is made in a greater or lesser amount than is specified on the document, the merchant will not be protected from the customer initiating a chargeback.

The form should be stored for at least three (3) months after the customer has been charged for the last time. For example, if the customer canceled their subscription, the merchant should keep their authorization form on file for at least ninety (90) days after their last payment.

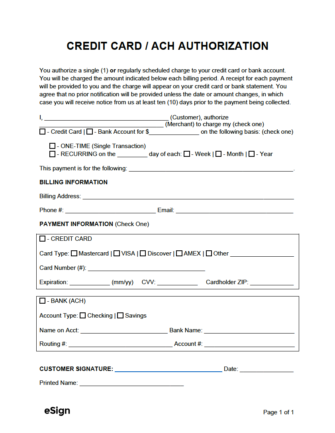

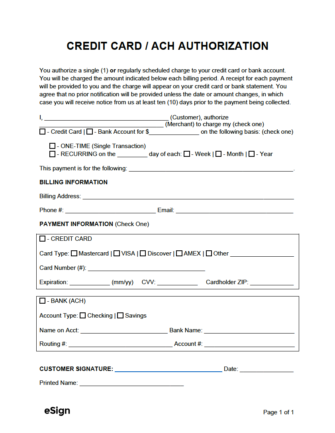

Download: PDF, Word (.docx), OpenDocument

At the top of the form, the following information will need to be provided:

Next, the frequency of billing will need to be selected.

This section pertains to the customer’s billing information.

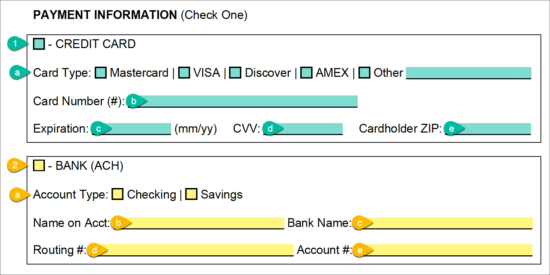

Select the appropriate checkbox to indicate the payment method the customer will be using.

1. If a credit card will be charged, select the “Credit Card” checkbox and provide the following information:

a) Card type (Mastercard, VISA, Discover, AMEX, or Other)

b) Card number (#)

c) Expiration date (mm/yy)

d) CVV (3-digit number on back of card)

e) Cardholder ZIP code

2. If a bank account will be charged directly, select the “Bank (ACH)” checkbox and provide the following information:

a) Account type (Checking or Savings)

b) Name on the account

c) Bank name

d) Routing number (#)

e) Account number (#)

Once the other fields have been completed, the customer will need to sign the form. This is a required step for making the form legally binding. The customer will need to provide the following information: