Howard Tillerman is the Chief Marketing Officer for Step By Step Business and an award-winning marketing professional.

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on July 28, 2021

$300,000 - $1.3 million p.a.

$150,000 - $400,000 p.a.

When opening your estate sale business, keep these essential aspects in mind:

You May Also Wonder:

What sells best at estate sales?

Some estate sale items tend to find buyers more quickly than others. Top on the list of fast-moving merchandise includes jewelry and accessories, designer wear and shoes, vintage art and décor items, and home tools and kits.

How do I determine the value of unique or rare items for sale?

To determine the value of unique or rare items, research and consult with experts in the field. Use online resources and auction records to find comparable items and their selling prices. Remember that an item’s value is subjective and can fluctuate over time.

What do estate sales do with leftovers?

While you’re at liberty to do whatever you want with estate sale leftovers, you’re better off buying the items and selling them later at a profit, hosting a public auction to dispose of the items, or donating them to charity.

Can you negotiate at estate sales?

In most cases, the estate sale company offers a marked price on the items. However, this doesn’t mean that you can’t ask for a discount. In fact, you can get a good deal if you push the sales executive to offer you the items at a discounted price.

How can I build relationships with customers and grow my estate sale business?

Build relationships with customers by providing excellent customer service and being transparent about the items being sold. Offer fair prices and communicate effectively with potential buyers. Use social media and email newsletters to promote your estate sales and keep customers updated. Word of mouth can also be a powerful tool for growing your business.

Before you start an estate sale business, you’ll want to understand the market dynamics first. That way, you can determine if venturing into the industry is worth your time and effort.

Weighing the rewards and pitfalls of any business allows you to know what you’re getting into. Here are some pros and cons of starting an estate liquidation business:

Estate sales, which involve the liquidation of all assets connected to an estate, is a market with great promise.

Though the US is home to 15,000 registered estate sale liquidators, that works out to just one company for every 8,500 households((https://www.statista.com/statistics/183635/number-of-households-in-the-us/)), suggesting unmet demand.

Trends shaping the estate sale market include:

Challenges in the estate sale industry include:

Among those who work for an estate sale company is an auctioneer, whose job is to invite bids for each item sold in an estate sale.

Startup capital for an estate sale company ranges between $2,000 on the low-end and $15,000 on the high-end. Most estate liquidators spend $8,500 on average to get their business off the ground.

A significant portion of this money goes toward buying equipment, branding, advertising, and marketing.

You’ll need a handful of items to successfully launch your estate sale business. Here’s a list to help you get started:

You may also need to lease a storage facility to keep unsold items for off-site estate sales.

Here’s the cost breakdown.

| Start-up Costs | Ballpark Range | Average |

|---|---|---|

| Licenses and permits | $100 - $100 | $100 |

| Insurance | $100 - $400 | $250 |

| Computers and equipment | $1,000 - $5,000 | $3,000 |

| Office supplies | $50 - $100 | $75 |

| Branding, marketing, and advertising | $500 - $7,000 | $3,750 |

| Website and software | $250 - $2,000 | $1,125 |

| Hiring | $0 - $400 | $200 |

| Total | $2,000 - $15,000 | $8,500 |

Estate sale revenue varies widely, as you’ll generate more from an estate that has high-value merchandise.

Most estate sale companies charge their clients somewhere between 25% and 50% of the value of all items sold, earning an average commission of 38%.

According to the Federal Reserve, the average American family has an estimated net worth of about $750,000. Setting aside the value of the real estate, the net worth drops to about $100,000.

At 25% commission, this means that every estate sale should generate $25,000 in revenue. If you handle one a month in your first year, you’d make $300,000 in annual revenue. Costs and overhead will leave you with a 50% margin, leaving you with an annual pre-tax profit of around $150,000.

Once you build your brand you might handle three estate sales every month. At this stage, you might rent an office space and hire staff, reducing your margin to 30%. If you’re able to achieve a 38% commission rate, you could generate more than $1.3 million in annual revenue. Assuming a 30% margin, you’d make a tidy $400,000 in profit.

Keep in mind, larger estate sale firms are able to close 10 or more estate sales per month and generate more than $1 million in annual profits!

The estate sale business has relatively few barriers to entry. The most notable obstacles include:

If you’re still not sure whether this business idea is the right choice for you, here are some related business opportunities to help you on your path to entrepreneurial success.

At this point, you have an overview of the market. Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

You’ll now want to develop your business idea further by working out the following aspects:

Your success as a professional estate sale company depends on your ability to identify opportunities faster than your competitors. Some of the best ways to identify business opportunities addressing an existing market gap or pain point, or turning your estate sale passion into a business.

You’re likely to succeed in the industry if you:

You might aim to fill a market niche with your estate sale business. For instance you could target baby boomers reaching retirement age or families looking to downsize amid the economic downturn.

While the estate sale business primarily involves liquidating a client’s estate items, it can be segmented based on the type of product, sale method, and target market. Below are the most common types of estate sale businesses:

In most cases, it takes just one day to complete an estate sale auction, though some estate sales last up to three days.

Apart from liquidating items, you can also incorporate other services into your business, including:

Estate sale companies charge 25% to 50% commission depending on the size of the estate, value of the merchandise, onsite security, type of items, and the need for other services, such as post-sale cleaning.

To determine what to charge, it’s best to evaluate the costs you’re likely to incur for a successful liquidation of your client’s estate. For instance, you can set a higher commission if the client asks you to dispose of any unsold items and clean the property.

It’s important to note that many estate liquidators offer 15% to 20% daily discounts to drive sales. This means items sold on the last day of the estate sale attract a lower commission. So, be sure to consider the expected sale price before you reach an agreement on your commission percentage with your client.

Further, you’ll want to check what your competitors are charging to ensure that your rate is within the industry standard. Once you know your costs, you can use this Step By Step profit margin calculator to determine your mark-up and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Identifying the right target audience for your business is one of the most critical elements of your marketing strategy. The main reasons people would want to liquidate their estate are the four D’s: death, divorce, debt, and downsizing. Thus, the primary target markets for your estate sale business will be heirs apparent, the recently divorced, debt-ridden families and people looking to downsize.

In the early stages, you may want to run your business from home to keep costs low. But as your business grows, you’ll likely need to hire workers for various roles and may need to rent out an office. You can find commercial space to rent in your area on sites such as Craigslist, Crexi, and Instant Offices.

When choosing a commercial space, you may want to follow these rules of thumb:

Here are some ideas for brainstorming your business name:

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that set your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Here are the key components of a business plan:

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you are planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to an estate sale.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

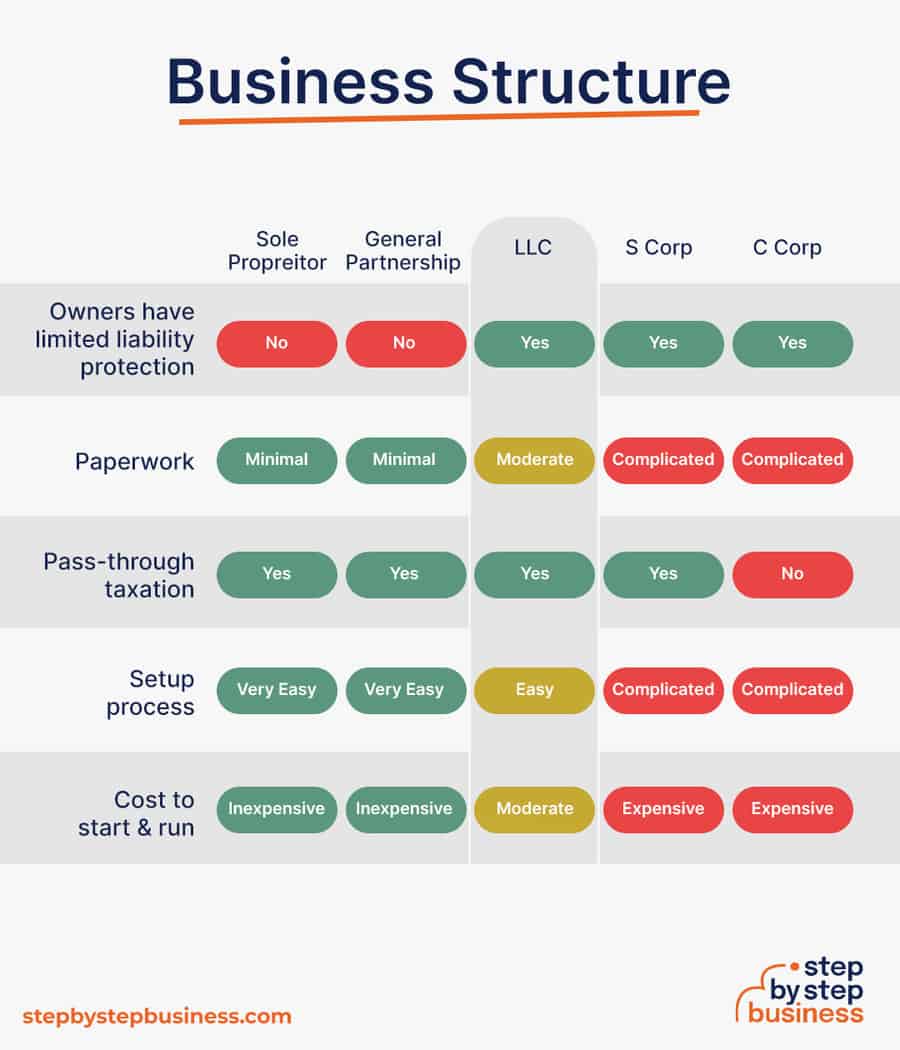

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your estate sale business will shape your taxes, personal liability, and registration requirements, so choose wisely.

Here are the main options:

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization, and answer any questions you might have.